Surge in “Sudden Deaths” Creates Increased Business for Funeral Industry while Life Insurance Industry Suffers due to Increased Death Payouts

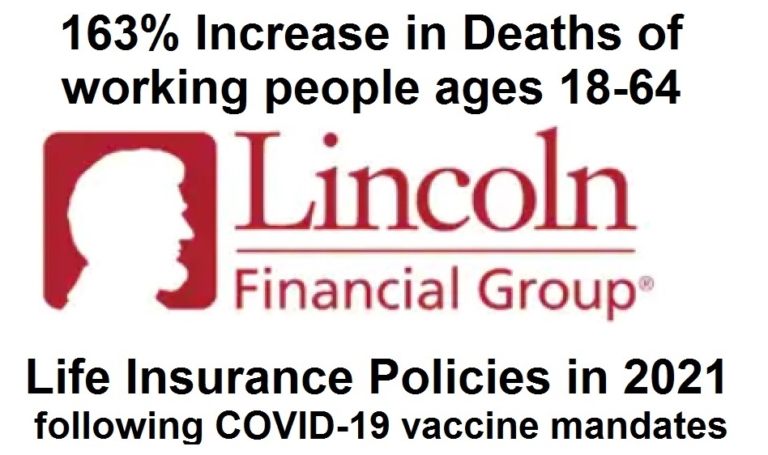

Today Service Corporation International, the largest for-profit funeral operator in North America, had its quarterly earnings call. So far in 2022 the company has made almost $500 million in profits - and its stock is up over 15% since last week's earnings report. It is not just funeral services companies. Market participants were somewhat stunned when Lincoln Financial announced results last week and shares collapsed over 30% after a shocking, and unexpected, $2.6 billion Q3 loss. “A Catastrophe (and Not the Natural Kind),” Wells Fargo Securities analysts said in a note to clients Wednesday night, following the after-market release of earnings by the Pennsylvania life-insurance and annuities company. What drove the big loss? Lincoln National group insurance death payouts for working age in USA 18-64 yr olds. 2019 is pre covid and is the baseline, 2020 covid hits no vaccine 9% increase, 2021 covid still here but now add the vaccine a 163% increase.