CBDCs Not Needed – Existing Cryptocurrencies Already Programmable to Create a Worldwide Ledger for Total Surveillance and Control

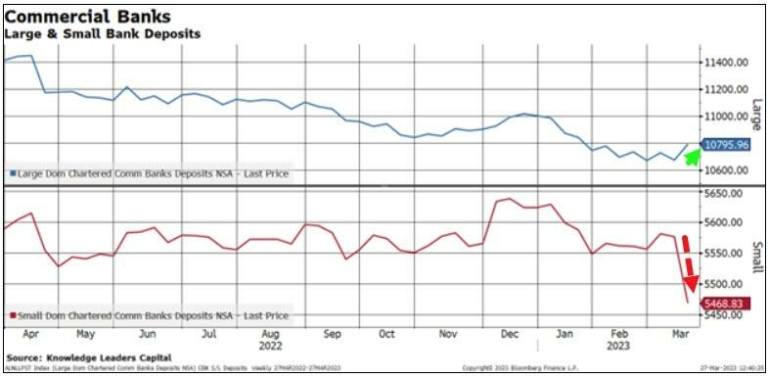

A year ago (March, 2023), I reported how the GOP was coming out in public to condemn Central Bank Digital Currencies (CBDC), a sure sign that this was a psyop to get the public upset and fearful over something while the financial system was planning on implementing the principles behind CBDCs without having to use CBDCs. Donald Trump and Robert F. Kennedy Jr., two of the candidates running for the office of the President of the United States this year, have also made similar promises to stop the implementation of CBDCs. Apparently they have been effective in scaring the public about the dangers of CBDCs, as earlier this month (March, 2024) Federal Reserve Chairman Jerome Powell came out in public and stated: “People don’t need to worry about a central bank digital currency, nothing like that is remotely close to happening anytime soon." While the U.S. public continues to be frightened about the possibilities of CBDCs, something else has been happening here in 2024, and that is the rapid advance in converting cryptocurrencies into assets, by getting the SEC to approve ETFs for existing cryptocurrencies, allowing anyone now to be able to invest in cryptocurrencies through the Stock Market without actually owning them. Leading the way in creating cryptocurrency ETFs is Larry Fink of BlackRock, head of the largest money-management firm in the world. BlackRock started 11 Bitcoin spot ETFs in January this year, the world's largest cryptocurrency, and is now set to do the same for Ethereum, the world's second most owned cryptocurrency. So why is Larry Fink in the process of turning cryptocurrencies into assets and obtaining control of this market? Let's let Larry Fink himself explain it: "We believe we're just halfway there in the ETF revolution...Everything is going to be ETF'd...We believe this is just the beginning. ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset." Larry Fink, 1/12/2024 on Bloomberg Television. In other words, everything the public fears from the Federal Reserve in terms of CBDCs, is already happening in the "private" sector with existing cryptocurrencies and their blockchains. All that is needed to convert over is a "Black Swan" (Corporate Media's term) or "False Flag" (Alternative Media's term) event.