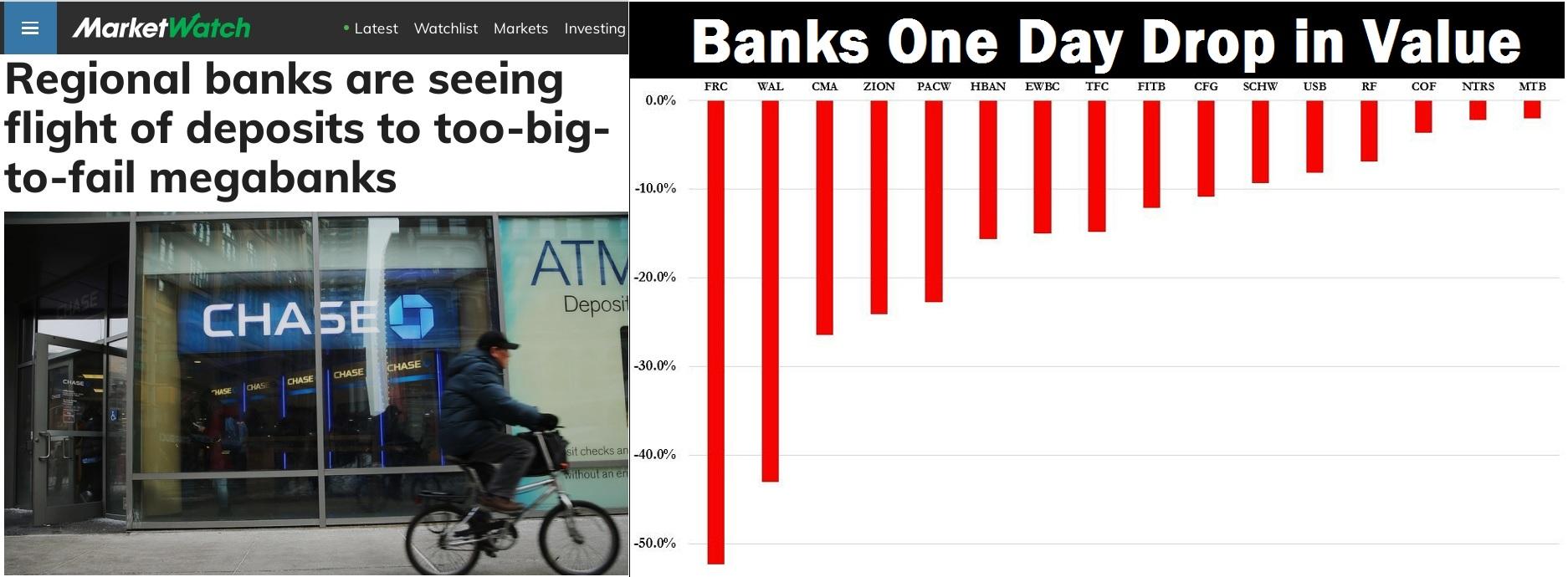

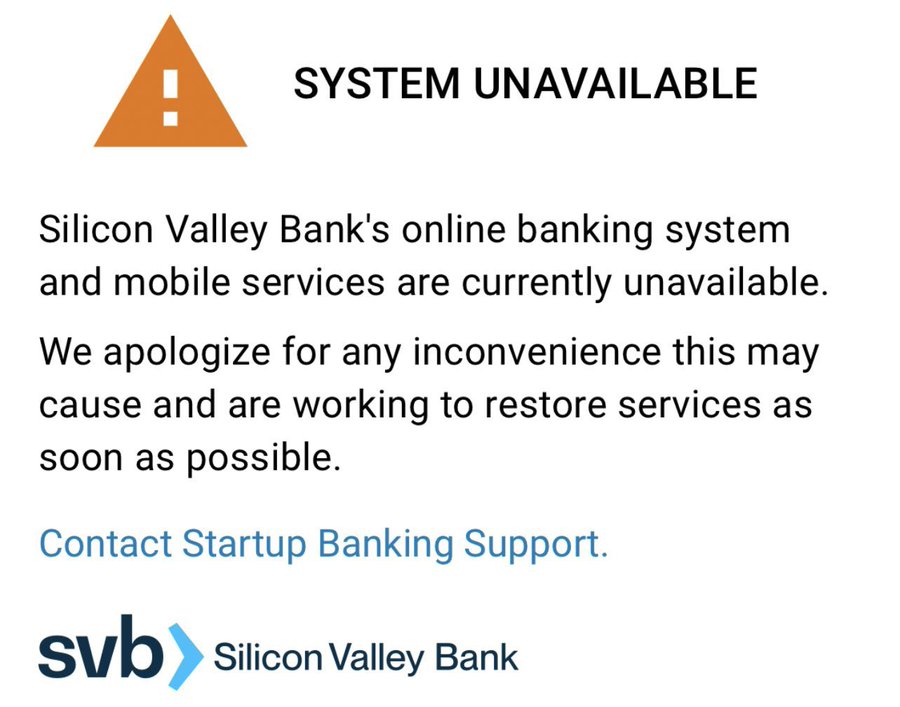

While the Fed's move yesterday (Sunday, March 12th) to bailout depositors from the Big Tech banks that crashed in recent days may have prevented a stock market crash today, it did not stop the bank runs, and more than 30 banks halted trading at one point today.

Most banking is done online now, so long lines at banks to withdraw funds are not something most are going to see these days. What is happening instead is that customers are withdrawing their funds from the riskier, mostly smaller banks, and putting them into larger banks that they believe are "too big to fail" because they believe the Fed will step in to prevent that.

While this is quickly turning into a partisan issue with each side blaming the other, open up your wallet and look at the color of your federal reserve notes (known as U.S. dollars). They are GREEN, not blue, and not red.

You "reap what you sow" is a fact of life, not only in agriculture (you can't plant corn and expect to harvest watermelons), but also in the financial world, and after years of corruption in the business world and financial markets, the time to reap the consequences seems to be upon us.

America has prospered for too long off the backs of cheap labor outside the U.S. while investments and start up firms have become just as risky and worthless as gambling in Las Vegas, throwing money around as entertainment without producing anything of real value.

This is a MORAL issue, not a political issue. The time to pay off our debts that we have immorally been ignoring for decades, no matter which political office has been in power, is now upon us it would seem.