Evangelical Christians Praying for Armageddon and Supporting the Death Penalty for “Antisemitism”

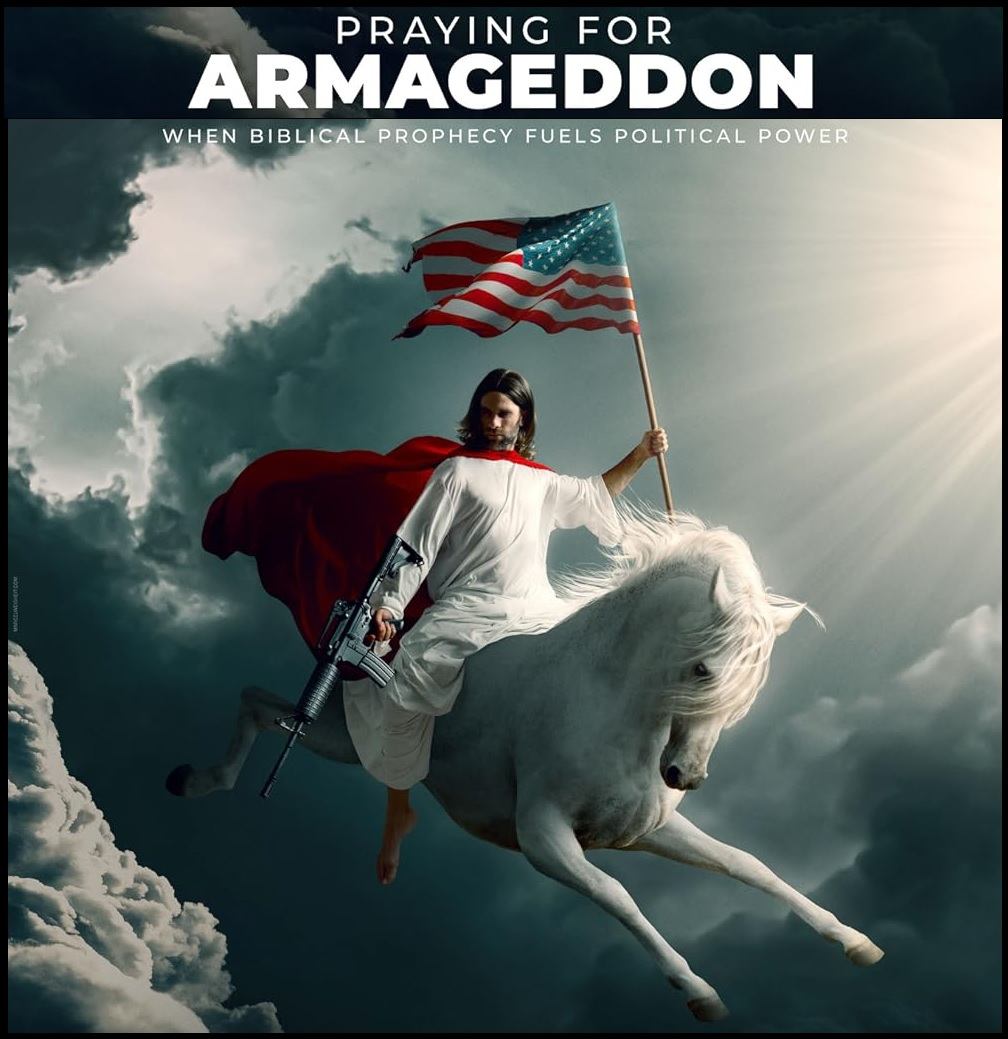

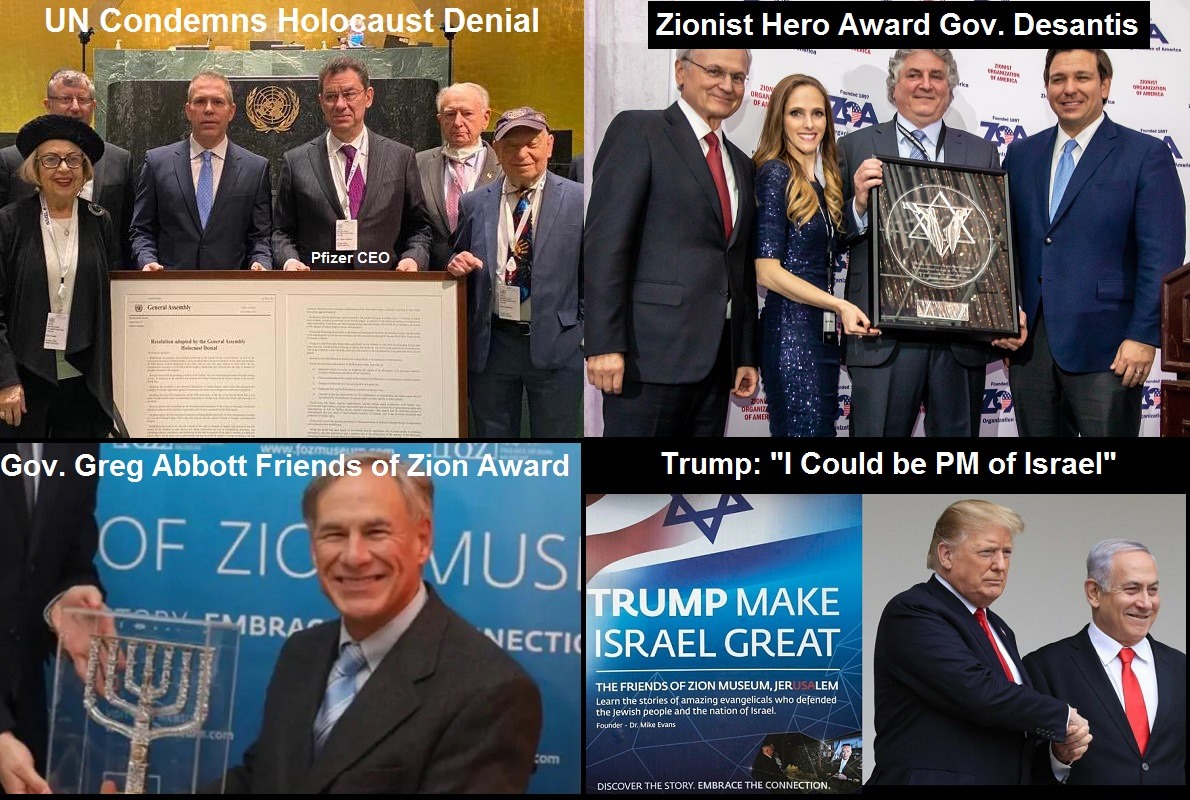

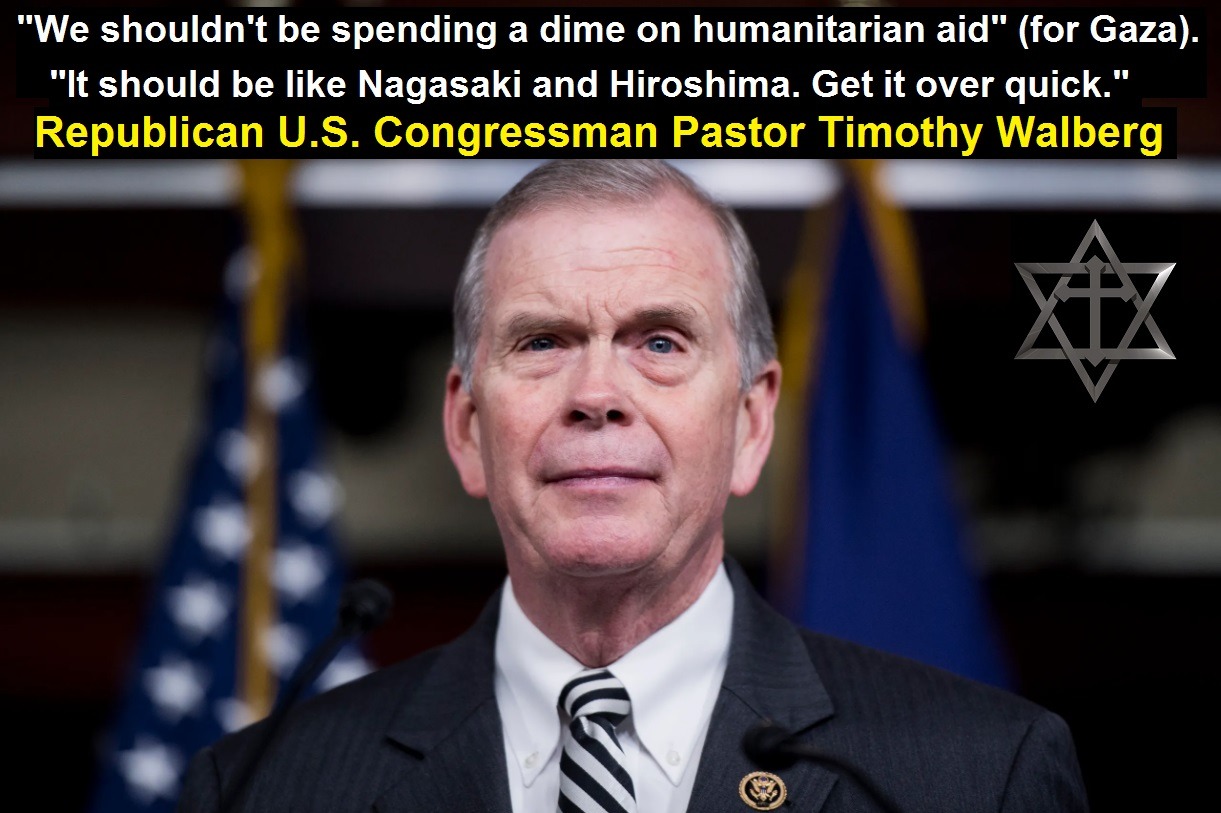

In March of 2023, several months before the current war between Hamas and Israel broke out, Norwegian film producer Tonje Hessen Schei premiered the documentary film, Praying for Armageddon: When Biblical Prophecy Fuels Political Power. What this documentary film does is expose the Christian Zionist Cult, from the non-Christian perspective. It was just re-released to the public a few weeks ago on Al Jazeera, who published it in two parts, both of which are now available for free to watch on YouTube. This is a very enlightening, and VERY timely, documentary to watch to understand the "other side" of how non-Christians and non-Americans view Evangelical Zionism. I highly recommend viewing this film, even though I don't agree with everything in it. It accurately exposes how massive amounts of money in Evangelical Christianity define and support Zionism politically. No Republican politician can ever lead the United States without being part of this Evangelical Christian Zionism movement, and wholeheartedly agreeing with it and the Zionist (mis)interpretation of the Bible. This documentary also reveals why President Trump, during his first term in office, moved the U.S. Embassy from Tel Aviv to Jerusalem, which legally gave the U.S. a presence in Jerusalem, so that if the U.S. Embassy was ever bombed by the enemies of Israel, it would be legally interpreted as an act of war against the United States. That international law that states all embassies and consulates are considered as part of the countries where they originate, and that any acts of violence or attack on these embassies would be legally considered as an act of war on that country which would then give that country the "right" to strike back, is EXACTLY what just happened with the Israeli attacks on the Iranian Embassy in Syria. The whole world knows that this was an act of war by Israel against Iran, and that Iran has a legal "right" to strike back, something that is considered imminent at the time of my writing this. And while everyone today seems to agree that Iran is about to make retaliatory strikes against Israel which they have a "legal right" right to do, what is not so clear is what the response of Israel and the United States is going to be, and if this is going to greatly escalate World War III. If it does, and if American lives are lost, look for stricter laws, executive orders, and emergency actions to be taken against "antisemitism", much like we saw during COVID with actions taken against "the unseen enemy (virus)", with mandatory orders (masks, lockdowns, social distancing, vaccines, etc.) given to allow continued participation in society. The main leader and face of the American Christian Evangelical Zionism movement today is undoubtedly Donald Trump, and he has already publicly stated that he wants a federal "death penalty" imposed for "antisemitism."