After weeks of speculation and reporting that the U.S. and Israel were about to bomb Iran, it finally happened earlier today, Saturday, February 28, 2026.

This story will now dominate news headlines for the next several days, at least.

I have purposely not reported on previous news reports about the "imminent" attack on Iran, because it was not clear yet if the U.S. was building up their military in the area to try and force Iran into some kind of deal, or if the Zionist Trump administration was waiting to see if the Epstein files saga would finally blow over and cease being part of the corporate news stream.

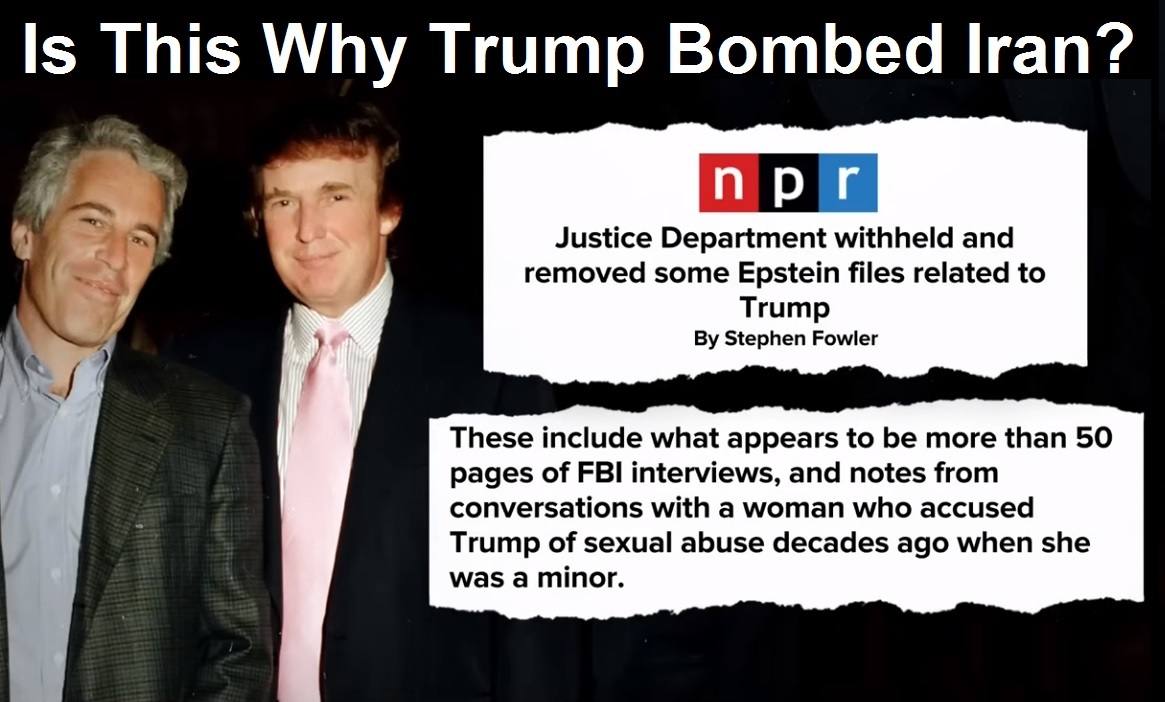

Well apparently the dam broke this past week, as the most explosive report yet out of the Epstein files clearly showed a cover-up with the FBI and an alleged victim of abuse by Trump as a minor, and Wall Street took massive losses in the final day of trading this week as fears grew over the actual state of the U.S. economy, and the future of Big Tech.

NPR was the first corporate media source who reported on the Justice Department and FBI cover-up that links Trump to Epstein and abusing children.

This is a very serious matter, because if Trump's DOJ broke the law, a lot of people should go to prison, including Trump.

The other big story this week that I was tracking was Anthropic's refusal to "take the guard rails off" of its AI app that was being used by Pentagon.

Anthropic stated that it refused to allow Claude, its AI app, to be used for "mass domestic surveillance or for fully autonomous weapons."

This infuriated Trump and his sidekick Pete Hegseth, who heads up the Department of War, who promptly "Black Listed" Anthropic after a Friday deadline passed.

This resulted in Anthropic’s Claude AI app to leapfrog OpenAI’s ChatGPT and Google's Gemini as the top AI app in the Apple Store. It became the #2 downloaded app altogether, after standing up to Trump.