by Brian Shilhavy

Editor, Health Impact News

November 8, 2022 will obviously be remembered in history as the day of the U.S. mid-term elections, but could another event that happened yesterday eclipse even the national elections?

Earlier this year I warned that cryptocurrencies were NOT safe havens to protect financial wealth, when Coinbase, the largest US crypto exchange service, announced that they had cut off 25,000 Russian wallets.

Crypto Currency WARNING! Coinbase Cuts Off 25K Russian Wallets!

As I noted then, I have never felt comfortable putting major resources into cryptocurrencies for several reasons, the most obvious one being that it is dependent upon “the system,” which requires, among other things, electricity and a working Internet.

New problems with cryptocurrencies were exposed yesterday, when the equivalent of a “bank run” happened when crypto exchange FTX saw $6 billion of withdrawals in a 72-hour span, resulting in them reportedly stopping the process of withdrawals yesterday.

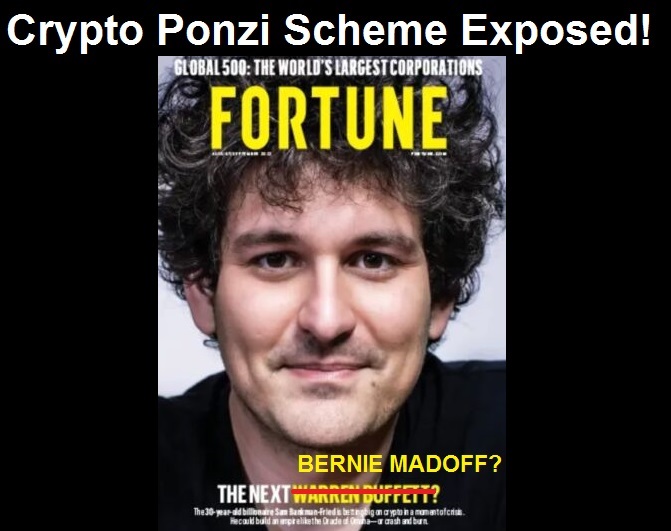

The August/September cover of Fortune Magazine raised the titillating question as to whether crypto billionaire Sam Bankman-Fried might be the next Warren Buffett – a man whose investment acumen has survived more than seven decades. Less than three months later, the public has its answer. Bankman-Fried’s crypto empire has turned to ruins in one week.

As it turns out, folks don’t have a lot of confidence in the crypto exchanges that hold their crypto. The equivalent of bank runs seen in the early 1930s, before federal deposit insurance was enacted by Congress in 1933, can wipe out a crypto exchange in a week’s time.

According to Reuters, Bankman-Fried’s crypto exchange, FTX, saw $6 billion of withdrawals in a 72-hour span through yesterday, leaving the exchange teetering amid questions about its solvency. (Source.)

Binance’s Changpeng Zhao appears to have cast the death blow on competitor FTX and its “billionaire” founder/CEO, Sam Bankman-Fried. Bankman-Fried’s fall from grace has been one of the more stunning losses of net worth in recent history. Despite there likely being issues under the surface prior to Tuesday, a massive $6 billion in withdrawals forced the company into a liquidity crisis. Its FTT token then crashed before SBF reached out to nemisis Zhao at Binance for a bailout.

The situation culminated in all of crypto crashing on Tuesday – including pulling down the entire stock market at points – and Bankman Fried losing a substantial portion of his net worth, according to Bloomberg. In fact, reports say he has lost 94% of his $16 billion fortune. (Source.)

Some big investors, including Blackrock and celebrity athletes including Stephen Curry and Tom Brady, were heavily invested in FTX.

From Tom Brady & Steph Curry To BlackRock: FTX Investors & Partners Feeling The Pain

Some of the prominent investors in the crypto exchange include – BlackRock, Ontario Pension Fund, Sequoia, Paradigm, SoftBank, Circle, Ribbit, Alan Howard, Multicoin, VanEck, and Temasek.

Celebrity investors also made their way to FTX. Basketball star Stephen Curry, for one, signed a partnership with the platform in September 2021. Interestingly, this was his first investment in the crypto industry while his – Eat.Learn.Play. – foundation joined hands with FTX on several charitable initiatives.

Another high-profile individual caught in the drama is National Football League (NFL) star quarterback Tom Brady. After many personal and professional setbacks, Brady’s net worth is now at a big-time risk.

The Football superstar and his wife, model Gisele Bündchen entered into a long-term relationship with FTX in 2020. It signaled his intention to enter the crypto industry. As part of the deal, both received Bitcoin in addition to an equity ownership stake in the company.

The former couple put their combined net worth of $650 million. While Brady was said to have taken up the role of FTX’s brand ambassador, the former Victoria’s Secret cover girl served as the environmental and social initiatives advisor. (Full article.)

Sam Bankman-Fried, once featured on the cover of Fortune Magazine as potentially the next “Warren Buffet,” and has now reportedly lost 94% of his $16 billion fortune, may be better compared to Bernie Madoff, as ZeroHedge News found an interview he did a few months ago where he admitted that crypto yield farming is basically a Ponzi business.

Over the summer, I was stunned when a friend of mine sent me an interview with FTX CEO and crypto billionaire Sam Bankman-Fried that I had never seen before. In the interview, Sam, who I recently noted knows more about the inner bowels of the defi/crypto space than anybody, basically came out and admitted that crypto lending was one giant Ponzi scheme.

Of course, many of us knew that the space was a ponzi scheme already – as I have been adamantly outspoken about – but it was the sheer, unadulterated, matter-of-fact-style, bald-faced admissions by Bankman-Fried that caused my jaw to drop when I read it and listened to it this week.

Now, looking back on it after FTX’s collapse this week, it’s even more stunning that nobody saw it coming. (Full article.)

The big question now is when will the other big Ponzi scheme rupture, the New York Stock Exchange, sending the U.S. and probably the rest of the world into financial ruins and usher in the Great Reset?

Comment on this article at HealthImpactNews.com.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

Support the case against Medical Kidnapping by purchasing our new book!

If you know people who are skeptical and cannot believe that medical kidnapping happens in the U.S. today, this is the book for them! Backed with solid references and real life examples, they will not be able to deny the plain evidence before them, and will become better educated on this topic that is destroying the American family.

1 Book – 228 pages

Retail: $24.99

FREE Shipping Available!

Now: $14.99

Order here!

2 Books

Retail: $49.98 (for 2 books)

FREE Shipping Available!

Now: $19.99 (for 2 books)

Order here!