by Brian Shilhavy

Health Impact News

The fact that the rapid rise in value for gold and silver for the past few weeks could actually be negative, is a thought that had never crossed my mind, until this week, when I tried to sell some of my gold, and found out just how difficult it was, and may soon be impossible.

I want to be very clear here that I am not offering financial advice, and that this article is ONLY about people who own physical gold and silver that they have in their possession. It has nothing to do with “paper gold” such as precious metal stocks and ETFs that are used for investments and a part of people’s investment portfolios which are traded on Wall Street.

I have almost no experience in that. There are a gazillion people on the Internet doing that already.

My own gold and silver coins are in a secure safe and bolted to the concrete base of the house where I stay.

Yesterday, January 27, 2026, I went to a local jewelry store where I have sold gold coins in the past, as I wanted to redeem some gold coins for a major purchase that was planned for this weekend.

I have been to this place several times in the past when I needed to cash in some gold, and know the management quite well. Their usual rate for gold bullion is $50 below spot, which is very competitive. Sometimes if I had a gold collector coin, I could bargain them down to $20 or $30 below spot.

When I walked in yesterday, the place was packed and there were more people there than I had ever seen before. When I got up to the teller and presented my gold, he looked up at a monitor and stated: “Our buy back price just went from 98% of spot, to 97% percent of spot, as the spot price just jumped again.”

He also stated that they were not paying out in cash, but only by check, and it was limited to one ounce of gold, about $5000.00, and that everything else above that would be paid by check after two weeks.

Wow! There went my plans to make a major purchase by this weekend!

Then the bomb fell. The guy who runs the place, who I like very well because he is non-partisan and, like me, believes that both political parties who run this country are equally corrupt, said to me:

You’re lucky we’re buying any gold at all.

He went on to explain that his buyers were stiffing him, and some invoices were already 60 days late in paying him.

Then he said:

If we wake up tomorrow, and the price of gold has shot up to $10,000 an ounce, we’re all going to suffer.

So I sold only one coin so I could get a check to deposit, and he told me I could come back in 24 hours and get another check of the same amount, providing that gold did not go up too high overnight.

Well, I live over an hour away from this place, so it is 2 hours of my time, minimum, just to sell some gold.

So when I got back, I checked to see if I could sell more online.

I have in the past sold gold online through the popular website, APMEX, one of the largest businesses that sells and buys gold in the U.S. And it is fast. Usually the entire transaction can happen in a few days with money deposited directly into one’s account.

The first thing I saw on the APMEX site to sell gold back to them was this message:

Due to record volume we currently have a $20,000 minimum on buy back orders.

Well, I wasn’t sure I wanted to sell that much, but I started the procedure from this page to get an instant quote, to see how they compared to the local jewelry shop who was now only offering me 97% of the spot price.

I made sure I entered in about 5 oz. of gold to meet the $20,000 minimum in order to get the quote.

But when I hit “submit”, it gave me an instant quote that was less than $10,000.00! That was obviously a mistake, and either a glitch in their software (is AI now running everything??), or they just did not want to provide a quote above $20,000 because they really did not want to buy any gold at all right now with the price increasing so fast.

The other option they give is to call them, where you tell them what you want to sell, and then get a quote that way.

So I tried that. Here is the message I received:

So then I went and read the “Update from the CEO“, which was published on Jan. 26th, two days before I am writing this article.

January 26, 2026

Dear Valued Customer,

In an effort not to sound like a record on repeat, markets continue to accelerate. Gold, silver, and platinum continue to set record highs, hitting levels many of us could not have imagined in such a short period of time. We are experiencing volumes that we have not seen in our history. This past weekend alone, order volume reached nearly seven times that of a normal weekend.

Compounding these challenges, Oklahoma City experienced one of the largest snow events in its history. We will always put the safety of our employees first, resulting in the shutdown of fulfillment and our mint for the weekend. We are up to 70% strength today and should be back to full strength by tomorrow. (Full update here.)

Now to be fair to APMEX, which is the only place I would recommend to anyone wanting to purchase or sell gold and silver online, I checked again before making my second trip the local jewelry store an hour away today.

I tried the same process again of getting a quote from their site as I had the day before, and this time when I clicked on “Submit”, I did NOT get a pop up instant quote with a timer ticking down, but was just informed that someone would email me within two business hours.

I didn’t wait the full two hours as I couldn’t, but when I got back I did have a quote from someone by email.

I checked the time the email came in, then used a graph from a financial site to see how much the gold spot value was during the day and chose the one that was the exact same time as the email came in, and it was 96% of spot, a full percentage point lower than what I got at the local jewelry store which gave me 97%.

And of course if I had chosen APMEX, they had already stated they would not even process my package for 8 business days after they received it.

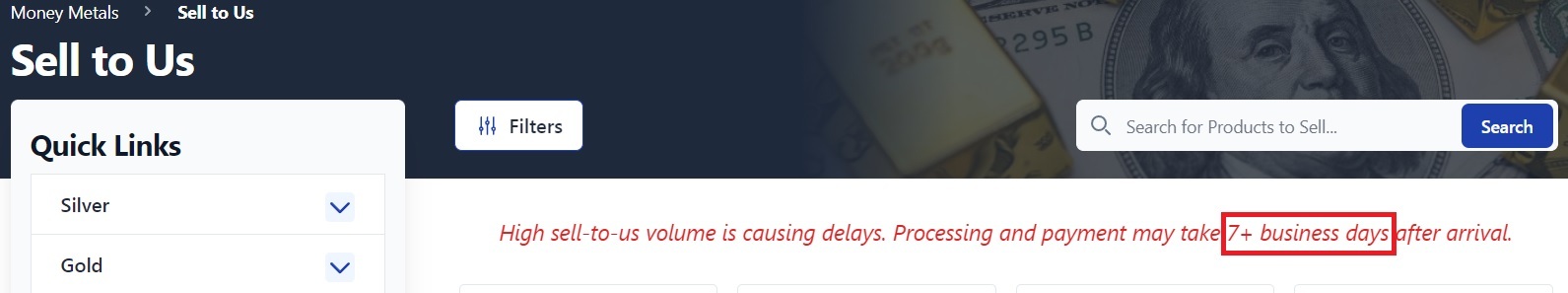

I checked some other popular websites that buy gold and silver, and for those that had a warning about buy backs, this was the most common message:

Yeah, and the part of that message that is dangerous is the “+“, which is open-ended and could turn to much longer times (months?) if this crisis continues.

Again, I am not giving anyone financial advice. I am calling this an “EXCLUSIVE” report because it is MY personal experience for the past two days.

And because almost everyone else invests in “paper gold”, I searched online and just did not see anyone else talking about this, yet (although I am sure there are some). Everyone seems to be in pure euphoria right now thinking that as the price of gold keeps going up, they are going to be rich.

I just always assumed that anytime I needed some quick cash I could just redeem some gold coins. But when my friend at the jewelry store told me yesterday “You’re lucky we’re buying any gold at all,” I realized that I had to adjust my thinking about my own physical gold quite a bit.

This is a liquidity crisis, and that crisis is here RIGHT NOW! The top dogs on the ladder of this liquidity crisis are, of course, the banks, and there are rumors that have been going around that some of these banks, like Chase Bank, have already been bailed out due to liquidity issues, especially silver which has probably never moved this fast in price in my lifetime.

They will never admit this, of course, because it will cause panic and bank runs, similar to what we saw in 2023 with the Silicon Valley bank runs.

I’ve always kept some cold hard cash on hand, mostly in $20 bills, for the day when the ATMs shut down and you can no longer get your money out of the bank.

What we have seen recently, is that when local storms come through and take down the grid, many local businesses, including gas stations, will only accept cash, because they cannot run credit cards without electricity.

I also own a lot of Lady Liberty silver coins, but I don’t sell those, because even if the price of silver hits a few hundred dollars per oz., if cash runs out in a down grid scenario, a lot of people will probably take a silver coin for barter.

But if you are holding on to your gold because you fully expect the price will keep rising (as it probably will), consider the facts I just learned the past two days, that this is not necessarily a good thing.

If your gold 1 oz coin or bullion bar all of a sudden is worth $10,000 an ounce based on the spot price, how are you going to spend it in a down-grid scenario?

Do you think you can drive in to your local gas station and ask them to fill your tank, and then give them a $10,000 gold coin, and they are going to give you change back?? Not a chance….

Again, I am NOT giving anyone any advice here. I just want you to have all the facts, as I did not have all the facts two days ago, but I do now, and I want YOU to to know these facts as well before you make any decisions that require you being able to cash in your gold or silver.

Comment on this article at HealthImpactNews.com.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.