by Brian Shilhavy

Editor, Health Impact News

For the past several years, America has produced more oil than the nation consumes, leading many to believe that the days of “Energy Crises,” such as we saw under President Carter back in the 1970s when people had to endure long lines just to fill up the gas tanks of their vehicles, were over.

A new class of Billionaires has taken their place in the U.S. economy for the past couple of decades or so, and they promised the world a “Green New Deal” that would eliminate our need for “fossil fuels.”

Some began to wonder if these new Billionaires, referred to collectively sometimes as the “Technocrats,” would now leverage technology to greatly improve our lives and rid us of our dependency on the oil tycoons in the Rockefeller Empire which basically built modern day America and Western culture.

They didn’t.

Whether by plan or by finally realizing that the promises of the technologists could not be kept, the oil tycoons are once again profiting from record prices of petroleum, even though the world now produces more oil than it ever has before.

Everyone now agrees that these gas prices, while currently dipping probably due to fewer drivers hitting the roads during the July 4th holiday, and far fewer flights than previous years due to labor shortages in the airlines industry, are going to continue to climb in the near future.

The only question unanswered is, how high?

Oil is Still King and Soon Only the Wealthiest People in the World May be Able to Afford it

John D. Rockefeller and son. 1921. Image source.

Here is an excerpt from an article published at Nasdaq.com earlier this year that explains why the U.S. is still dependent on oil imports, even though we produce more oil than we consume:

The U.S does indeed produce enough oil to meet its own needs. According to the U.S. Energy Information Administration (EIA), in 2020 America produced 18.4 million barrels of oil per day and consumed 18.12 million. And yet that same report reveals that the U.S. imported 7.86 million barrels of oil per day last year.

That happens because of a combination of economics and chemistry. The economics are simple: overseas oil, even after shipping costs, is often cheaper than domestically-produced crude. That is because what oil people call “lifting costs,” the cost of actually getting the oil out of the ground, are so much lower in some other countries. That, in turn, is down to a number of factors. Environmental and other regulations here play a part in that cost differential of course, but, contrary to what some would have you believe, they are far from the be-all and end-all in affecting prices.

Land and lease prices are a big factor, as are labor and other costs. Then there is the fact that so many countries, and Russia is definitely one of them, that see oil exports as an important strategic and geopolitical tool. In those cases, these nations give concessions to ensure that their oil is sold at an advantageous price. Right now, Vladimir Putin is being accused of weaponizing energy supply, but it is something that he and other dictators and human rights abusers have been doing for years to make client nations, including the U.S., ignore who they are and what they do.

Still, the U.S. probably wouldn’t be one of those client nations at all if it weren’t for the chemistry.

You see, the U.S. does produce enough oil to meet its own needs, but it is the wrong type of oil.

Crude is graded according to two main metrics, weight and sweetness. The weight of oil defines how easy it is to refine, or break down into its usable component parts, such as gasoline, jet fuel and diesel. Light crude is the easiest to handle, heavy is the most difficult, with intermediate obviously somewhere in between. The sweetness refers to the sulfur content of unrefined oil. The sweeter it is, the less sulfur it contains.

Most of the oil produced in the U.S. fields in Texas, Oklahoma, and elsewhere is light and sweet, compared to what comes from the Middle East and Russia. The problem is that for many years, imported oil met most of the U.S.’s energy needs, so a large percentage of the refining capacity here is geared towards dealing with oil that is heavier and less sweet than the kind produced here.

A coordinated, forward-looking energy policy over the last few decades would have targeted that issue through subsidies and incentives. That money has been paid out anyway: it wouldn’t have been hard to use it to make America truly energy independent. However, politicians, it seems, would rather keep a situation where periodic energy crises give them a cudgel with which to beat an incumbent. Lest you think I am making a partisan point here, current criticism is of a Democrat by Republicans, but the last time crude was at these levels it was Democrats criticizing George W. Bush, a Republican, for policies and actions that they said forced oil higher back then.

So, we are left in a place where the U.S., despite producing more crude than it needs, is dependent on imports. When the country feels it must ban imports from Russia because of an unprovoked attack on an ally, it is forced to go cap in hand to countries such as Saudi Arabia, Venezuela, and Iran to make up the difference. That is not the fault of Joe Biden, Donald Trump, Barack Obama, George W. Bush, or any other individual politician. It is the fault of all of them and of every Congressperson and oil executive who prioritized a partisan lever over reducing America’s dependence on imported oil over the last thirty or forty years. (Full article.)

The current sanctions against Russia are only making this problem worse. The recent G7 plans to restrict the flow of oil coming out of Russia could cause the price of oil to increase to $380 a barrel according to some analyses, and if that happens, millions of people are going to starve and die.

Oil Price Could Hit “Stratospheric” $380 If Russia Retaliates To G7 Oil Price Cap

Excerpts:

As discussed previously, one of the most notable events of the past week was the decision by G7 leaders “to work” on a price cap for Russian oil as part of efforts to cut Moscow’s revenues.

However, it didn’t take long for the same G7 motley crew to realize that they have a major problem on their hands: as JPM’s commodity desk notes, given Russia’s strong fiscal position, the country can cut up to 5 mbd of production without excessively hurting its economic interest. Meanwhile, a 5mbd cut would spark a Europe-wide depression, confirming that once again Europe had not even done the simple math.

What about prices? According to JPM, given the high levels of stress in the oil market, a cut of 3.0 mbd could cause global Brent price to jump to $190/bbl, while the most extreme scenario of a 5 mbd slash in production could drive oil price to a stratospheric $380/bbl. (Full article.)

And while President Biden is scheduled to visit Saudi Arabia to beg them for some oil, it’s not going to happen. Even though the current price of oil has declined recently, Saudi Arabia is expecting demands to increase the rest of this summer, and just announced huge price increases:

With oil tumbling almost 10% this morning, one would think that a major oil consuming country has suddenly gone dark, plunging into a deep depression.

The answer, as so often happens, is just the opposite, and in fact on Tuesday Saudi Arabia raised next month’s oil prices for its biggest market of Asia to match all time highs, amid signs that underlying demand is soaring despite what one would concludes are growing recessionary concerns if only merely looked at the price of oil.

As shown in the chart below, oil giant Saudi Aramco raised its key Arab Light crude grade for Asian customers by $2.80/bbl from July to $9.30 above the regional benchmark, just 5 cents shy of a record high!

The Saudis also lifted the prices of all other grades for Asia in August, with Extra Light at a record premium. Aramco announced smaller increases in the prices of Extra Light, Arab Light, and Medium to both the Mediterranean region and northwest Europe. All prices for the U.S. market remain the same as last month’s, Bloomberg reported.

The market viewed the price increase as a sign that the world’s top crude oil exporter expects robust demand this summer despite growing fears of a recession that could sink demand. (Full article.)

The outlook in Europe is even worse, as the Nord Stream 1 pipeline from Russia to Europe is currently mostly closed down due to maintenance, and its schedule to resume full operations by July 22 is anything but certain.

A few days ago, Deutsche Bank strategist Jim Reid asked if July 22 would be the most important day of the year for both Europe and the rest of the world, as that’s the day when Russian gas should resume transit on the Nord Stream 1 pipeline, to wit: “while we all spend most of our market time thinking about the Fed and a recession, I suspect what happens to Russian gas in H2 is potentially an even bigger story. Of course by July 22nd parts may have be found and the supply might start to normalise. Anyone who tells you they know what is going to happen here is guessing but as minimum it should be a huge focal point for everyone in markets.”

Hinting that they may have some clue what happens with Europe’s gas market in three weeks, overnight Goldman’s European commodity strategists wrote a note titled “Increased supply risks lead us to raise our TTF forecasts” in which they note that the 60% reduction in Russian gas exports via the Nord Stream 1 (NS1) pipeline in place since mid-Jun has left net Russian flows to NW Europe near zero, with most of what’s left in the pipe re-exported out of Germany towards Czech Republic and from there to other buyers. This has raised gas supply uncertainty in Europe ahead of NS1’s full maintenance in mid-July, driving TTF prices up 70% in the period to 168 EUR/MWh as a result, the highest since the Ukraine invasion in March.

Why does this matter? Because as Goldman’s Samantha Dart writes, while she initially assumed a full restoration of NS1 flows following its upcoming maintenance event, she no longer see this as the most probable scenario; “instead, the lack of resolution around required turbine repairs, and the absence of any Gazprom-driven re-routing of the reduced NS1 flows via an alternative pipeline to mitigate the impact to supply suggest a prolonged reduced flow rate at NS1 is more likely going forward.” (Full article.)

The Green New Deal is a Failure – Commodities Still Trump Technology

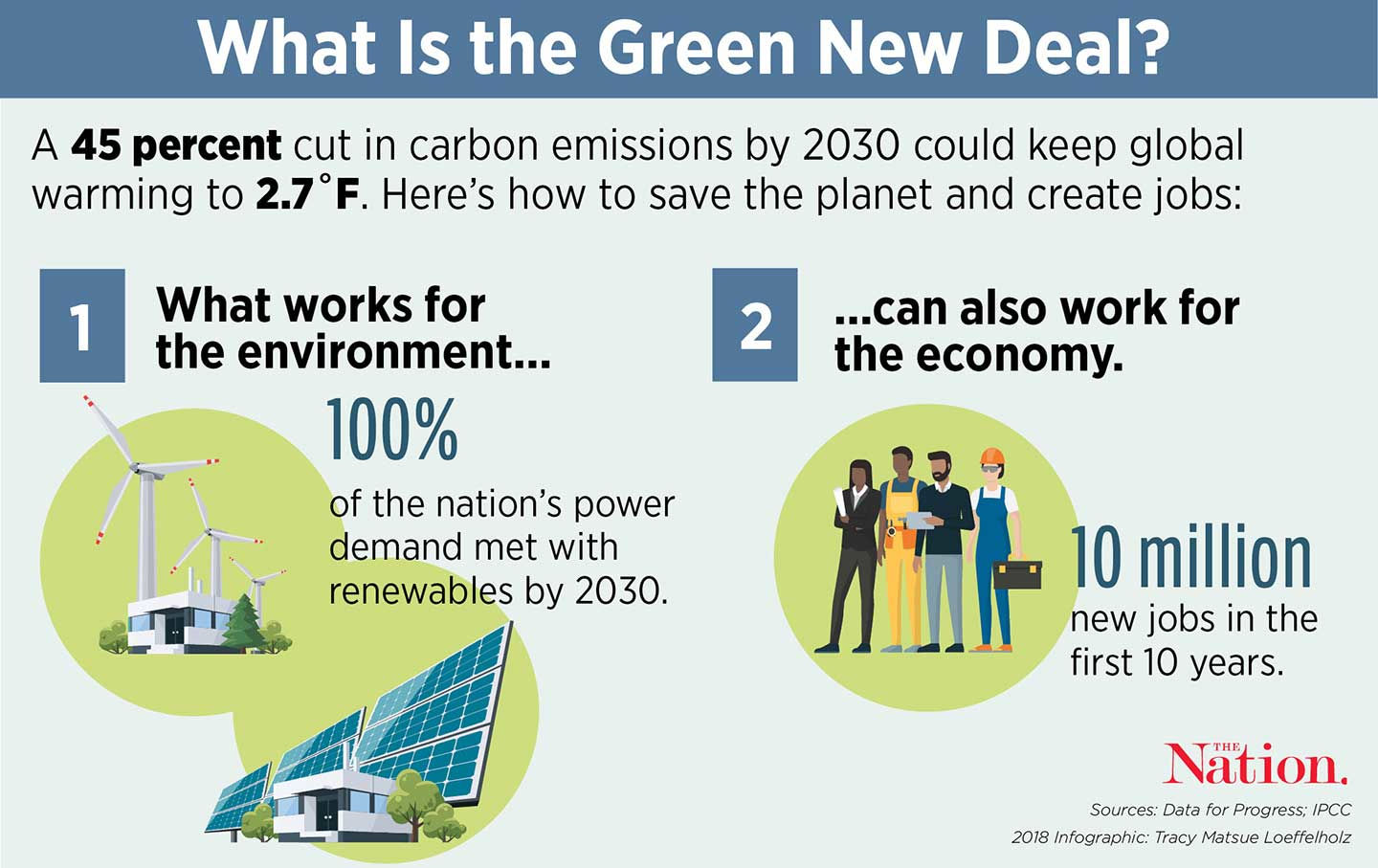

The Green New Deal’s false promises.

The primary political ideology that has led us back to impending energy crises is the nonsense called “The Green New Deal” which promised prosperity by switching to “renewable energies” such as solar and wind.

The problem with most career politicians is that most of them have never worked in the real economy, and are economically illiterate because they have never produced anything.

They (most of them) don’t know that legislation, such as forcing the private sector to produce renewable energy and phase out “fossil fuels,” is economic suicide.

So now auto manufacturers are rushing to hybrids and EVs, not because consumers in the marketplace demand them, but because the technocrats told everyone this is the way it needs to be done, and they bought off the politicians to create the market for them.

But electric battery vehicles still need to be manufactured, which is dependent on natural resources, and they have to be serviced and maintained, which requires retraining a major section of the workforce, which is rapidly declining due to COVID vaccine injuries and deaths, and sterilizing child-bearing young women.

Warner Todd Huston, writing for The Western Journal, recently reported about this problem of switching over to electric vehicles so rapidly.

Car Dealers Reveal an Alarming Problem with Getting Your Electric Vehicle Serviced

Excerpts:

So, you bowed to the pressure to buy an electric vehicle and you are ready for the big savings to pile up. But just when you thought you were in the money, you found a whole new problem keeping your car off the road and causing expenses to soar.

Electric vehicles are supposed to allow owners to grin giddily as they pass one gas station after another, saving the driver hundreds with every pump they pass. But there are an awful lot of issues on the downside that EV dealers are not exactly thrilled to tell potential buyers.

For instance. What happens when your EV breaks down and you need service?

Apparently, in many cases, not much is the answer to that.

The industry is warning new EV owners that they may have a little problem finding qualified service technicians when their EVs have issues, Fox News Business Network reported.

Dealerships, especially, are warning that even they are having trouble finding enough qualified techs to service the cars.

“The government’s wanting to make this transition and shift to EVs, and there are several concerns around that in the automotive vertical and specifically the dealership world,” Sean Kelley, founder of CarMotivators, told FNBN.

Kelly added that service shops are facing a serious shortage of mechanics who have been trained to work on electric cars.

That isn’t the only problem service shops are having. The sets of specialized tools that the shops need to purchase are extremely expensive and are not in great supply.

Then there are the new charging stations needed to recharge the cars they are servicing. These stations often mean repair shops to begin “tearing apart your whole shop” to rearrange their floor plan to accommodate them, Kelly said.

Small, independent dealerships have it worse, Kelly added, because they don’t have a cost-effective pipeline to the original equipment manufacturer tools and information and find it harder to deal with EV repairs.

This makes the costs of gearing up to include EV repairs extremely difficult for all car dealers, including the big dogs. (Full article.)

While the Globalists are still trying to scare everyone into believing that the technology is going to take over the world with “transhumanism,” with most in the Alternative Media going right along with this CIA-level mind control, such as the recent announcement that Google “fired” (more likely pulled a PR stunt) an engineer that claimed their AI robot was “sentient,” the truth is that the technology is dependent upon natural resources, including electricity, most of which is still produced by “fossil fuels,” and it is also dependent upon human resources, a diminishing commodity today.

Transhumanism and AI “sentient” robots are science fiction stories conceptualized by the Hollywood entertainment industry, and are not based in reality, nor will they ever be See:

What is Life?

Those Globalists who still control the world’s natural resources, including oil, have either known this all along, or have finally figured it out.

The technology is failing, and it will crash, because it needs fuel to operate, natural resources to build, and human resources to maintain.

If the technocrats who developed all this junk weren’t such maniacs and psychopaths, I would actually feel sorry for them.

But I predict that technocrats like Elon Musk will probably die in poverty, when all his Teslas sit useless in junk yards and his satellites start raining down to earth broken and useless, because money alone, especially federal reserve U.S. dollars created out of thin air, will not keep them working.

The dot.com bust back in 2000 will look like a drop in the ocean compared to when the technology starts failing and the entire economic system crashes. Many of us Y2K preppers were expecting the economy to crash in 2000, but our society is even more fragile today then it was 22 years ago, especially with the reduction of working age Americans who have now died or been crippled by the COVID shots today.

Charles Hugh Smith is an economist who understands this, and so I will end this article with his most recent blog post. As he so correctly points out, without the manufacturing resources to make things, even a cheap kitchen “toaster” becomes impossible to fix or produce.

But don’t worry, Bill Gates, Jeff Bezos, Elon Musk, Larry Ellison, and all their technocrat buddies have promised us a “Green New Deal” which will save the planet and provide jobs for everyone.

The non-technocrat Globalists are not buying it (and neither should you!) as they still control the natural resources of the world, including oil.

Commodities still trump technology, and Russia, China, the Middle East and others control much of the world’s natural resources, and they are demanding their place now in the coming New World Order.

WWW III has already started, and the “hot war” portion beyond Ukraine seems inevitable now. See:

World War III Has Started – How Did we Get Here and What’s Next? A Non-Western Perspective

If you want a glimpse of what potentially awaits us with high fuel prices, see what is currently happening in Sri Lanka:

Sri Lanka under virtual lockdown as fuel restricted for pvt cars. (Source.)

The One Solution to All Our Problems

Pick one, America: national security of the essential material foundation of everything, the industrial base, or “global markets,” maximizing greed / corporate profits.

Sorry about the clickbait title. We all know there isn’t “one solution” to anything as complex as a socio-economic-cultural-political system.

But this is based on looking at all the problems from one very shaky perspective: that the foundations of any solutions are rock-solid and all we need to do is apply some ideological or financial fix and away we go.

From another, much more practical perspective, if you don’t keep the foundation–the industrial base–glued together, then all the high-minded ideological or financial fixes will all be completely, utterly meaningless. When the generator breaks down and can’t be fixed due to a lack of critical spare parts, that isn’t a problem that has a “Progressive” or “Conservative” fix. Printing money and tax breaks won’t fix it either. And neither will ideological fixations like “global markets.”

Financial gimmicks and global markets are what got us into this mess in the first place. Greed is good until you sacrifice your national security and industrial base for a few extra bucks.

From this perspective, there is one solution to all the problems, because if you don’t fix the industrial base then the whole shebang collapses. All those little things like a judiciary, law enforcement and food supply system all rely on a functional industrial base, by which I mean the interwoven industries that made the millions of essential parts and components of a complex industrial economy.

We all know about fuel and fertilizer, but when you look beneath this superficial surface you find a bunch of stuff without which the entire industrial machine breaks down.

Here is a partial list of the stuff you need or your industrial base collapses in short order: plastics, sealants, solvents, lubricants, gaskets, O-rings, filters, and an astoundingly long list of highly specialized ceramics, wires, piping, fabrics, glass, steel, lenses and so on.

To a sobering degree, much of this essential industrial base has been offshored because “greed is good” and corporate profits are more important than the security of the nation’s industrial base. Becoming dependent on frenemies’ industrial base is (pick as many as apply): short-sighted, stupid, foolish, insane, traitorous.

The problem isn’t just the loss of the capacity to make the stuff we need to keep the whole system from collapsing; it’s the loss of the capacity to make all the parts and components. All complex systems, including machines, fail when a critical component fails or a critical fluid runs dry. The machine can be 99.9% functional but the missing 0.1% means the entire machine is down.

Most people are unaware of just how dependent we are on specialty parts produced in only a handful of factories. It simply isn’t profitable in the “global marketplace” to produce small batches of parts. The “greed is good” / maximize profit ideology leads to stripping away redundancies and costly local suppliers in favor of a distant supplier totally within the control of frenemies’ governments.

Consider the supposedly low-tech kitchen counter toaster. These are cheap, so they must be easy to make, right? Wrong. They’re impossible to make without a highly sophisticated industrial supply chain. Thomas Thwaites attempted to make a toaster from scratch and found it was impossible to do so. He described the experience in his book, The Toaster Project: Or a Heroic Attempt to Build a Simple Electric Appliance from Scratch.

Even the simple kitchen toaster requires highly specialized materials from a handful of sources. There is nothing low-tech about the specialty wires, ceramics, etc. needed to manufacture or repair a “simple” toaster.

The one solution without which no other solutions are possible is to reshore our essential industrial base and supply chain as a matter of the highest national security. Production deemed essential to National Security must be located in the U.S. and owned and operated by U.S. firms.

Ideological purists freak out at the prospect that “greed is good, markets fix everything” has failed the nation but these blinded-by-ideology purists overlook how government funding via DARPA, NASA and DoD (Department of Defense) was the one and only driver of the development of microprocessors and the entire semiconductor industry. There was no private-sector market to enable greed, and no way that individuals in a garage could fabricate the first microprocessors. All the really hard stuff was funded lock, stock and barrel, by DARPA, NASA and DoD–government agencies devoted to national security, which includes the government’s role in fostering and nurturing innovation. (DARPA was ARPA back in the day).

Pick one, America: national security of the essential material foundation of everything, the industrial base, or “global markets,” maximizing greed / corporate profits. You can’t have both. Choosing “global markets,” maximizing greed / corporate profits has left the nation catastrophically vulnerable in ways few even grasp because they don’t understand the fragility of the material foundation of all the goodies and systems they wrongly assume are a permanent birthright. They aren’t.

We’re getting a taste of the inherent instability of our dependence on “global markets” / maximizing greed, but the full banquet of consequences has yet to be served.

When the machine breaks down due to lack of essential parts, the magic goes away. Do those behind the curtain understand this? Apparently not. Maybe we need a few engineers behind the curtain instead of relying on financiers and legal experts for leadership.

Read the full article at Of Two Minds

Related:

The Financial Apocalypse Begins

Comment on this article at HealthImpactNews.com.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

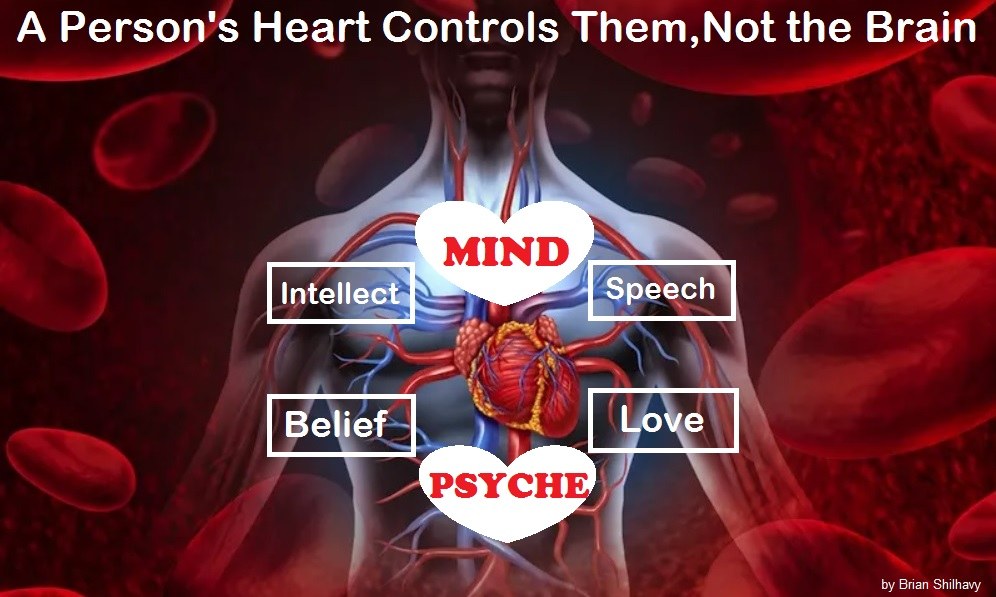

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

Support the case against Medical Kidnapping by purchasing our new book!

If you know people who are skeptical and cannot believe that medical kidnapping happens in the U.S. today, this is the book for them! Backed with solid references and real life examples, they will not be able to deny the plain evidence before them, and will become better educated on this topic that is destroying the American family.

1 Book – 228 pages

Retail: $24.99

FREE Shipping Available!

Now: $14.99

Order here!

2 Books

Retail: $49.98 (for 2 books)

FREE Shipping Available!

Now: $19.99 (for 2 books)

Order here!