Original image source.

by Brian Shilhavy

Editor, Health Impact News

The severity of the economic disaster facing the United States continues to be minimized if not altogether ignored by the corporate media, as they use very tame words such as “recession” and “bear market” to describe the current financial conditions we are all facing.

I have confirmed this week that people are already starting to suffer from high prices on gasoline and rising prices on food, as many food banks across the country are seeing dramatic increases in traffic, while the supply of donated food to many of these food pantries is diminishing.

And things are just going to get worse, not better, so there is little time left to prepare for what is going to be the total collapse of the financial system, and the implementation of the Great Reset, which will bail out the Globalist bankers and Wall Street Billionaires and place the rest of society into a slave market, where cash will disappear, and new Central Bank Digital Currencies will be implemented for those who comply with this new system.

China is currently further ahead in implementing this new Great Reset than most other countries, as most of its residents cannot travel or participate in the economy without their digital IDs which the government controls.

For the rest of this article I am going to include perspectives on the current financial situation and what lies ahead from the alternative media, which is where you need to go now to truly understand what is happening and to combat the propaganda from the corporate media, which is controlled by the same Globalists who are implementing this “Great Reset.”

The Engineered Stagflationary Collapse Has Arrived – Here’s What Happens Next

by Brandon Smith

Alt-Market.us

In my 16 years as an alternative economist and political writer I have spent around half that time warning that the ultimate outcome of the Federal Reserve’s stimulus model would be a stagflationary collapse. Not a deflationary collapse, or an inflationary collapse, but a stagflationary collapse. The reasons for this were very specific – Mass debt creation was being countered with MORE debt creation while many central banks have been simultaneously devaluing their currencies through QE measures. On top of that, the US is in the unique position of relying on the world reserve status of the dollar and that status is diminishing.

It was only a matter of time before the to forces of deflation and inflation met in the middle to create stagflation. In my article ‘Infrastructure Bills Do Not Lead To Recovery, Only Increased Federal Control’, published in April of 2021, I stated that:

“Production of fiat money is not the same as real production within the economy… Trillions of dollars in public works programs might create more jobs, but it will also inflate prices as the dollar goes into decline. So, unless wages are adjusted constantly according to price increases, people will have jobs, but still won’t be able to afford a comfortable standard of living. This leads to stagflation, in which prices continue to rise while wages and consumption stagnate.

Another Catch-22 to consider is that if inflation becomes rampant, the Federal Reserve may be compelled (or claim they are compelled) to raise interest rates significantly in a short span of time. This means an immediate slowdown in the flow of overnight loans to major banks, an immediate slowdown in loans to large and small businesses, an immediate crash in credit options for consumers, and an overall crash in consumer spending. You might recognize this as the recipe that created the 1981-1982 recession, the third-worst in the 20th century.

In other words, the choice is stagflation, or deflationary depression.”

It’s clear today what the Fed has chosen. It’s important to remember that throughout 2020 and 2021 the mainstream media, the central bank and most government officials were telling the public that inflation was “transitory.” Suddenly in the past few months this has changed and now even Janet Yellen has admitted that she was “wrong” on inflation. This is a misdirection, however, because the Fed knows exactly what it is doing and always has. Yellen denied reality, but she knew she was denying reality. In other words, she was not mistaken about the economic crisis, she lied about it.

As I outlined last December in my article ‘The Fed’s Catch-22 Taper Is A Weapon, Not A Policy Error’:

‘First and foremost, no, the Fed is not motivated by profits, at least not primarily. The Fed is able to print wealth at will, they don’t care about profits – They care about power and centralization. Would they sacrifice “the golden goose” of US markets in order to gain more power and full bore globalism? Absolutely. Would central bankers sacrifice the dollar and blow up the Fed as an institution in order to force a global currency system on the masses? There is no doubt; they’ve put the US economy at risk in the past in order to get more centralization.’

The Fed has known for years that the current path would lead to inflation and then market destruction, and here’s the proof – Fed Chairman Jerome Powell actually warned about this exact outcome in October of 2012:

“I have concerns about more purchases. As others have pointed out, the dealer community is now assuming close to a $4 trillion balance sheet and purchases through the first quarter of 2014. I admit that is a much stronger reaction than I anticipated, and I am uncomfortable with it for a couple of reasons.First, the question, why stop at $4 trillion? The market in most cases will cheer us for doing more. It will never be enough for the market. Our models will always tell us that we are helping the economy, and I will probably always feel that those benefits are overestimated. And we will be able to tell ourselves that market function is not impaired and that inflation expectations are under control. What is to stop us, other than much faster economic growth, which it is probably not in our power to produce?

When it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response. So there are a couple of ways to look at it. It is about $1.2 trillion in sales; you take 60 months, you get about $20 billion a month. That is a very doable thing, it sounds like, in a market where the norm by the middle of next year is $80 billion a month. Another way to look at it, though, is that it’s not so much the sale, the duration; it’s also unloading our short volatility position.”

As we all now know, the Fed waited until their balance sheet was far larger and until the economy was MUCH weaker than it was in 2012 to unleash tightening measures. They KNEW the whole time exactly what was going to happen.

It is no coincidence that the culmination of the Fed’s stimulus bonanza has arrived right after the incredible damage done to the economy and the global supply chain by the covid lockdowns. It is no coincidence that these two events work together to create the perfect stagflationary scenario. And, it’s no coincidence that the only people who benefit from these conditions are proponents of the “Great Reset” ideology at the World Economic Forum and other globalist institutions. This is an engineered collapse that has been in the works for many years.

The goal is to “reset” the world, to erase what’s left of free market systems, and to establish what they call the “Shared Economy” system. This system is one in which the people who survive the crash will be made utterly dependent on government through Universal Basic Income and one that will restrict all resource usage in the name of “carbon reduction.” According to the WEF, you will own nothing and you will like it.

The collapse is engineered to create crisis conditions so frightening that they expect the majority of the public to submit to a collectivist hive mind lifestyle with greatly reduced standards. This would be accomplished through UBI, digital currency models, carbon taxation, population reduction, rationing of all commodities and a social credit system. The goal, in other words, is complete control through technocratic authoritarianism.

All of this is dependent on the exploitation of crisis events to create fear in the population. Now that economic destabilization has arrived, what happens next? Here are my predictions…

The Fed Will Hike Interest Rates More Than Expected, But Not Enough To Stop Inflation

Today, we are witnessing the poisonous fruits of a decade-plus of massive fiat money creation and we are now at the stage where the Fed will reveal its true plan. Hiking interest rates fast, or hiking them slow. Fast hikes will mean an almost immediate crash in markets (beyond what we have already seen), slow hikes will mean a drawn out process of price inflation and general uncertainty.

I believe the Fed will hike more than expected, but not enough to actually slow inflation in necessities. There will be an overall decline in luxury items, recreation commerce and non-essentials, but most other goods will continue to climb in cost. It is to the advantage of globalists to keep the inflation train running for another year or longer.

In the end, though, the central bank WILL declare that the pace of interest rates is not enough to stop inflation and they will revert to a Volcker-like strategy, pushing rates up so high that the economy simply stops functioning altogether.

Markets Will Crash And Unemployment Will Abruptly Spike

Stock markets are utterly dependent on Fed stimulus and easy money through low interest rate loans – This is a fact. Without low rates and QE, corporations cannot engage in stock buybacks. Meaning, the tools for artificially inflating equities are disappearing. We are already seeing the effects of this now with markets dropping 20% or more.

The Fed will not capitulate. They will continue to hike regardless of the market reaction.

As far as jobs are concerned, Biden and many mainstream economists constantly applaud the low unemployment rate as proof that the American economy is “strong,” but this is an illusion. Covid stimulus measures temporarily created a dynamic in which businesses needed increased staff to deal with excess retail spending. Now, the covid checks have stopped and Americans have maxed out their credit cards. There is nothing left to keep the system afloat.

Businesses will start making large job cuts throughout the last half of 2022.

Price Controls

I have no doubt that Joe Biden and Democrats will seek to enforce price controls on many goods as inflation continues, and there will be a handful of Republicans that will support the tactic. Price controls actually lead to a reduction in supply because they remove all profits and thus all incentive for manufacturers to keep producing goods. What usually happens at that point is government steps in to nationalize manufacturing, but this will be substandard production and at a much lower yield.

In the end, supplies are reduced even further and prices go even higher on the black market because no one can get their hands on most goods anyway.

Rationing

Yes, rationing at the manufacturing and distribution level is going to happen, so be sure to buy what you need now before it does. Rationing occurs in the wake of price controls or supply chain disruptions, and usually this coincides with a government propaganda campaign against “hoarders.”

They will hold up a few exaggerated examples of people who buy truckloads of merchandise to scalp prices on the black market. Then, not long after, they will accuse preppers and anyone who bought goods BEFORE the crisis of “hoarding” simply because they planned ahead.

Rationing is not only about controlling the supply of necessities and thus controlling the population by proxy; it is also about creating an atmosphere of blame and suspicion within the public and getting them to snitch on or attack anyone that is prepared. Prepared people represent a threat to the establishment, so expect to be demonized in the media and organize with other prepared people to protect yourself.

Be Ready, It Only Gets Worse From Here On

It might sound like I am predicting success of the Great Reset program, but I actually believe the globalists will fail in the end. That’s not going to stop them from making the attempt. Also, the above scenarios are only predictions for the near term (within the next couple of years). There will be many other problems that stem from these situations.

Naturally, food riots and other mob actions will become more commonplace, perhaps not this year, but by the end of 2023 they will definitely be a problem. This will coincide with the return of political unrest in the US as leftist factions, encouraged by globalist foundations, demand more government intervention in poverty. At the same time, conservatives will demand less government interference and less tyranny.

At bottom, the people who are prepared might be called a lot of mean names, but as long as we organize and work together, we will survive. Many unprepared people will NOT survive. Understand that the economic conditions ahead of us are historically destructive; there is no way that serious consequences can be avoided for a large part of the population, if only because they refuse to listen and to take proper steps to protect themselves.

The denial is over. The crash is here. Time to take action if you have not done so already.

Read the full article at Alt-Market.us.

Our Economy In a Nutshell

by CHARLES HUGH SMITH

Of Two Minds

The economy has reached an inflection point where everything that is unsustainable finally starts unraveling.

Our economy is in a crisis that’s been brewing for decades. The Chinese characters for the English word crisis are famously–and incorrectly–translated as danger and opportunity. The more accurate translation is precarious plus critical juncture or inflection point.

Beneath its surface stability, our economy is precarious because the foundation of the global economy– cheap energy–has reached an inflection point: from now on, energy will become more expensive.

The cost will be too low for energy producers to make enough money to invest in future energy production, and too high for consumers to have enough money left after paying for the essentials of energy, food, shelter, etc., to spend freely.

For the hundred years that resources were cheap and abundant, we could waste everything and call it growth: when an appliance went to the landfill because it was designed to fail (planned obsolescence) so a new one would have to be purchased, that waste was called growth because the Gross Domestic Product (GDP) went up when the replacement was purchased.

A million vehicles idling in a traffic jam was also called growth because more gasoline was consumed, even though the gasoline was wasted.

This is why the global economy is a “waste is growth” Landfill Economy. The faster something ends up in the landfill, the higher the growth.

Now that we’ve consumed all the easy-to-get resources, all that’s left is hard to get and expensive. For example, minerals buried in mountains hundreds of miles from paved roads and harbors require enormous investments in infrastructure just to reach the deposits, extract, process and ship them to distant mills and refineries. Oil deposits that are deep beneath the ocean floor are not cheap to get.

Does it really make sense to expect that the human population can triple and our consumption of energy increase ten-fold and there will always be enough resources to keep supplies abundant and prices low? No, it doesn’t.

Many people believe that nuclear power (fusion, thorium reactors, mini-reactors, etc.) will provide cheap, safe electricity that will replace hydrocarbons (oil and natural gas). But nuclear power is inherently costly, and there are presently no full-scale fusion or thorium reactors providing cheap electricity to thousands of households.

Reactors take many years to construct and are costly to build and maintain. Cost over-runs are common. A new reactor in Finland, for example, is nine years behind schedule and costs have tripled.

The U.S. has built only two new reactors in the past 25 years.

The world’s 440 reactors supply about 10% of global electricity. There are currently 55 new reactors under construction in 19 countries, but it will take many years before they produce electricity. We would have to build a new reactor a week for many years to replace hydrocarbon-generated electricity. This scale of construction simply isn’t practical.

Supplying all energy consumption globally–for all transportation, heating of buildings, etc.) would require over 10,000 reactors by some estimates–over 20 times the current number of reactors in service.

Many believe so-called renewable energy such as solar and wind will replace hydrocarbons. But as analysts Nate Hagens has explained, these sources are not truly renewable, they are replaceable; all solar panels and wind turbines must be replaced at great expense every 20 to 25 years. These sources are less than 5% of all energy we consume, and it will take many decades of expansion to replace even half of the hydrocarbon fuels we currently consume.

To double the energy generated by wind/solar in 25 years, we’ll need to build three for each one in service today: one to replace the existing one and two more to double the energy being produced.

All these replacements for hydrocarbons require vast amounts of resources: diesel fuel for transport, materials for fabricating turbines, panels, concrete foundations, and so on.

Humans are wired to want to believe that whatever we have now will still be ours in the future. We don’t like being told we’ll have less of anything in the future.

The current solution is to create more money out of thin air in the belief that if we create more money, then more oil, copper, iron, etc. will be found and extracted.

But this isn’t really a solution. What happens if we add a zero to all our currency? If we add a zero to a $10 bill so it becomes $100, do we suddenly get ten times more food, gasoline, etc. with the new bill? No.

Prices quickly rise ten-fold so the new $100 bill buys the same amount as the old $10.

Adding zeroes to our money (hyper-financialization) doesn’t make everything that’s scarce, expensive and hard to get suddenly cheap. It’s still scarce, expensive and hard to get no matter how many zeroes we add to our money.

Many people feel good about recycling a small part of what we consume. But recycling is not cost-free, and the majority of what we consume is not recycled.

The percentage of lithium batteries that are recycled, for example, is very low, less than 5%. We have to mine vast quantities of lithium because we dump 95% of lithium-ion batteries in the landfill. There are many reasons for this, one being that the batteries aren’t designed to be recycled because this would cost more money.

The majority of all manufactured goods–goods that required immense amounts of hydrocarbons to make–are tossed in the landfill.

Goods and services are commoditized and sourced from all over the world in long dependency chains (hyper-globalization): if one link breaks, the entire supply chain breaks.

Our economy is precarious because it’s in a lose-lose dilemma: resource prices can’t stay high enough for producers to make a profit without impoverishing consumers. Prices can’t stay low enough to allow consumers to spend freely without producers losing money and shutting down, depriving the economy of essential resources.

Playing hyper-financialized games–creating money out of thin air, borrowing from tomorrow to spend more today and inflating speculative bubbles in stocks, housing, etc.–won’t actually create more of what’s scarce. All these games make wealth inequality worse (hyper-inequality), undermining social stability.

The economy has reached an inflection point where everything that is unsustainable finally starts unraveling. Each of these systems is dependent on all the other systems (what we call a tightly bound system), so when one critical system unravels, the crisis quickly spreads to the entire economic system: one domino falling knocks down all the dominoes snaking through the global economy.

Those who understand how tightly interconnected, unsustainable systems are basically designed to unravel can prepare themselves by becoming antifragile: flexible, adaptable and open to the opportunities that arise when things are disorderly and unpredictable.

Read the full article at Of Two Minds.

US Federal Reserve Working On Digital Currency As Global ‘Role Of The Dollar’ At Risk

by Kelen McBreen

Infowars.com

United States Federal Reserve Chairman Jerome Powell on Friday hinted at major monetary changes shaking up the global financial system in the near future.

NEW – Powell: "Rapid changes are taking place in the global monetary system that may affect the international role of the dollar."

A US central bank digital currency is being examined to "help the US dollar's international standing." pic.twitter.com/htP6r1brNz

— Disclose.tv (@disclosetv) June 17, 2022

Speaking at the Federal Reserve Board’s “International Roles of the U.S. Dollar” research conference in Washington D.C., Powell began by describing the dollar’s role as the world’s reserve currency in the post-WWII era.

After explaining the benefits of the dollar’s international role, Powell changed his tone and warned, “Looking forward, rapid changes are taking place in the global monetary system that may affect the international role of the dollar in the future.”

He continued, saying, “Most major economies already have or are in the process of developing instant, 24/7 payments. Our own FedNow service will be coming online in 2023. And in light of the tremendous growth in crypto-assets and stablecoins, the Federal Reserve is examining whether a U.S. central bank digital currency (CBDC) would improve on an already safe and efficient domestic payments system.“

Citing a Federal Reserve white paper on the subject, Powell claimed a U.S. CBDC “could also potentially help maintain the dollar’s international standing.”

The Federal Reserve conference took place as Russian President Vladimir Putin delivered a speech at the annual St. Petersburg International Economic Forum (SPIEF).

The Russian president said Western nations are blaming global inflation on Russia’s war in Ukraine instead of the massive amount of money printed over several decades.

President #Putin at SPIEF: Russia's special military operation has become a "lifeline" for the #Western elites to blame all the problems on #Russia.

"They printed money in huge quantities, and then what? That's where global inflation comes from".— Cicke 🇷🇸 🇷🇺 🇺🇸☮ (@Cicke69) June 17, 2022

Putin also acknowledged huge global economic shifts are on the horizon, saying, “We are talking about real processes, about truly revolutionary, tectonic changes in geopolitics, global economy, the technological sphere, in the entire system of international relations.”

The Russian leader said, “The unipolar world era is finished,” and that new, powerful nations are ready to take a new role on the world stage.

A “change of elites” in the West will follow a “revolutionary” change sparked by Europe and America’s response to the war in Ukraine, he added.

“Such a detachment from reality, from the demands of society, will inevitably lead to a surge of populism and the growth of radical movements, to serious social and economic changes, to degradation, and in the near future, to a change of elites,” Putin said.

Continuing, Putin claimed, “some global currencies are committing suicide.”

Read the full article at Infowars.com.

Related:

CENSORED: $4.5 TRILLION Bank Bailout 4th Quarter 2019 Months Before COVID Exceeded 2008 Bailouts

Comment on this article at HealthImpactNews.com.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

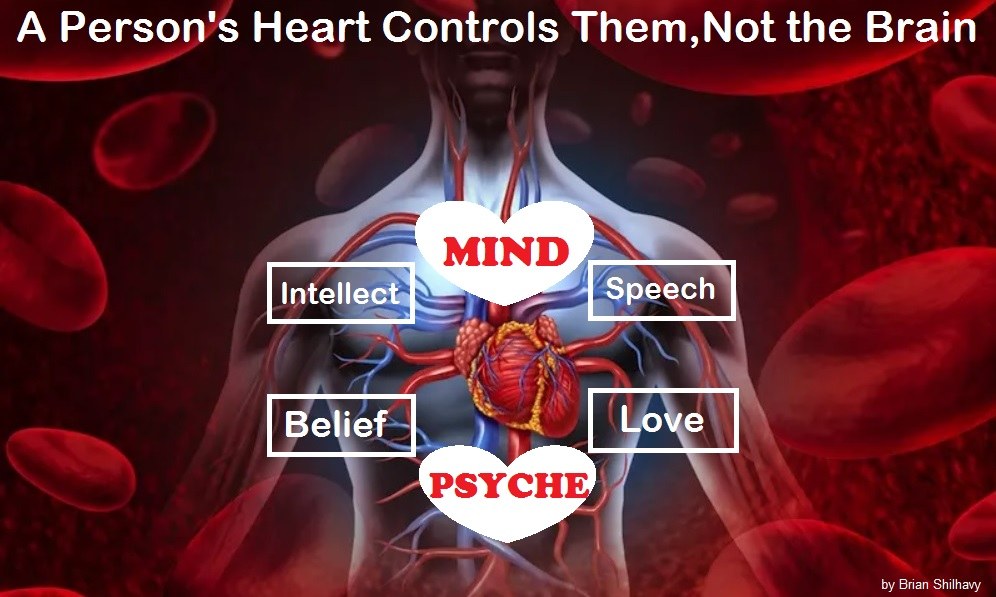

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

Support the case against Medical Kidnapping by purchasing our new book!

If you know people who are skeptical and cannot believe that medical kidnapping happens in the U.S. today, this is the book for them! Backed with solid references and real life examples, they will not be able to deny the plain evidence before them, and will become better educated on this topic that is destroying the American family.

1 Book – 228 pages

Retail: $24.99

FREE Shipping Available!

Now: $14.99

Order here!

2 Books

Retail: $49.98 (for 2 books)

FREE Shipping Available!

Now: $19.99 (for 2 books)

Order here!